Jakarta’s fintech scene is booming—and 2025 promises even more innovation and competition. From payments and lending to crypto and SME tools, these startups are reshaping how Indonesians manage, move, and invest their money.

Here are 13 fintech startups in Jakarta that you need to know about this year.

Julio

Source: julo.co.id.

JULO is one of Jakarta’s leading digital lending platforms, offering unsecured micro-loans to smartphone users across Indonesia. By leveraging behavioral-based rewards—such as cashback and increased credit limits for timely payments—JULO has successfully attracted millions of users who need fast and flexible financing. With its user-friendly app and AI-powered risk assessment, JULO is helping to bridge the gap between traditional banks and underbanked Indonesians.

Pintu

Source: pintu.co.id.

Pintu, founded in 2020, is one of Indonesia’s most popular crypto-asset platforms. Its mobile-first design makes it easy for users to buy, sell, and manage cryptocurrencies like Bitcoin, Ethereum, and more. Pintu prioritizes user education and security, which has helped it build a loyal following among both beginners and seasoned traders. As crypto adoption in Indonesia continues to rise, Pintu is well-positioned to lead the way

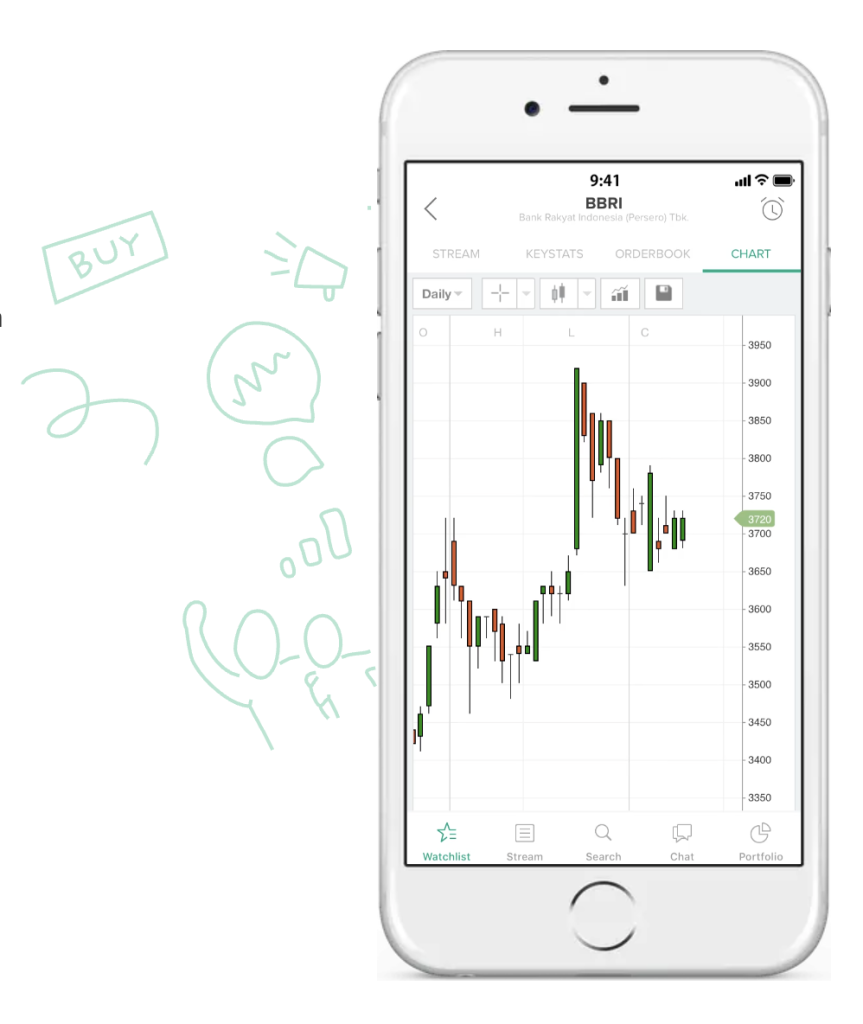

Stockbit

Source: stockbit.com.

Stockbit has revolutionized stock investing in Indonesia by combining a social community with robust trading features. Investors can analyze stock performance, discuss market trends, and execute trades—all within a single platform. This social investing model has helped Stockbit build a strong user base among young professionals eager to invest collaboratively

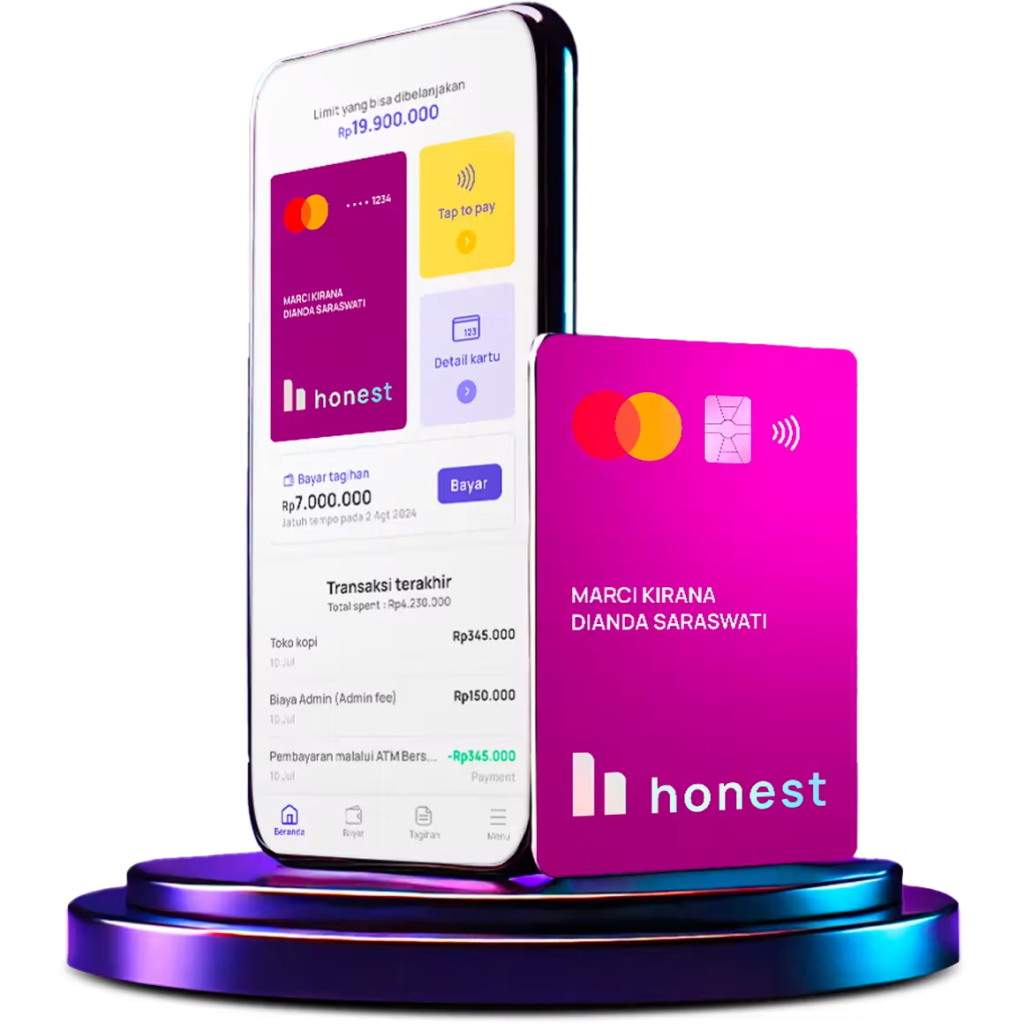

Honest

Source: honest.co.id.

Launched in 2022, Honest is a credit card fintech that’s disrupting the industry with its numberless NFC-enabled cards. Honest offers real-time alerts, biometric verification, and transparent fee structures—features that have already attracted over one million users. Its focus on security and simplicity makes it a compelling choice for millennials and Gen Z users looking for a smarter way to manage credit.

Akulaku

Source: akulaku.com.

Akulaku is a regional heavyweight in the “buy now, pay later” (BNPL) space and digital banking. Beyond offering virtual credit cards, Akulaku provides consumer financing, insurance, and e-commerce loans, serving over 26 million users across Southeast Asia. With a valuation approaching US$2 billion, Akulaku is one of Jakarta’s most valuable fintechs and continues to expand its offerings to meet diverse consumer needs.

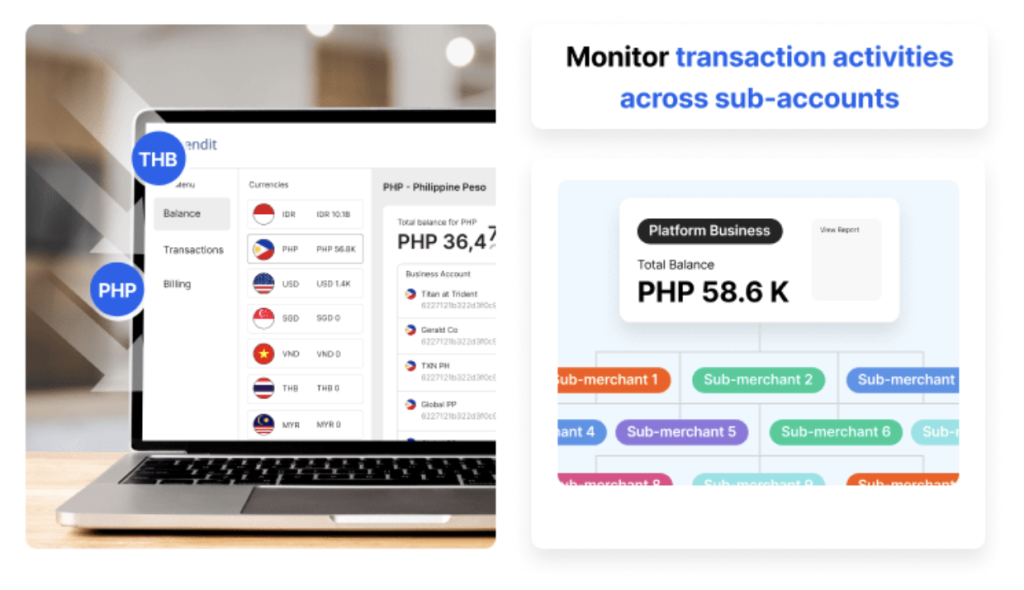

Xendit

Source: xendit.co.

Xendit is Indonesia’s premier payments infrastructure provider, offering APIs that enable businesses to accept payments, manage subscriptions, and combat fraud. Its platform has become the backbone of countless e-commerce sites, SaaS companies, and financial institutions across Southeast Asia. With its commitment to reliability and security, Xendit is driving the region’s digital transformation.

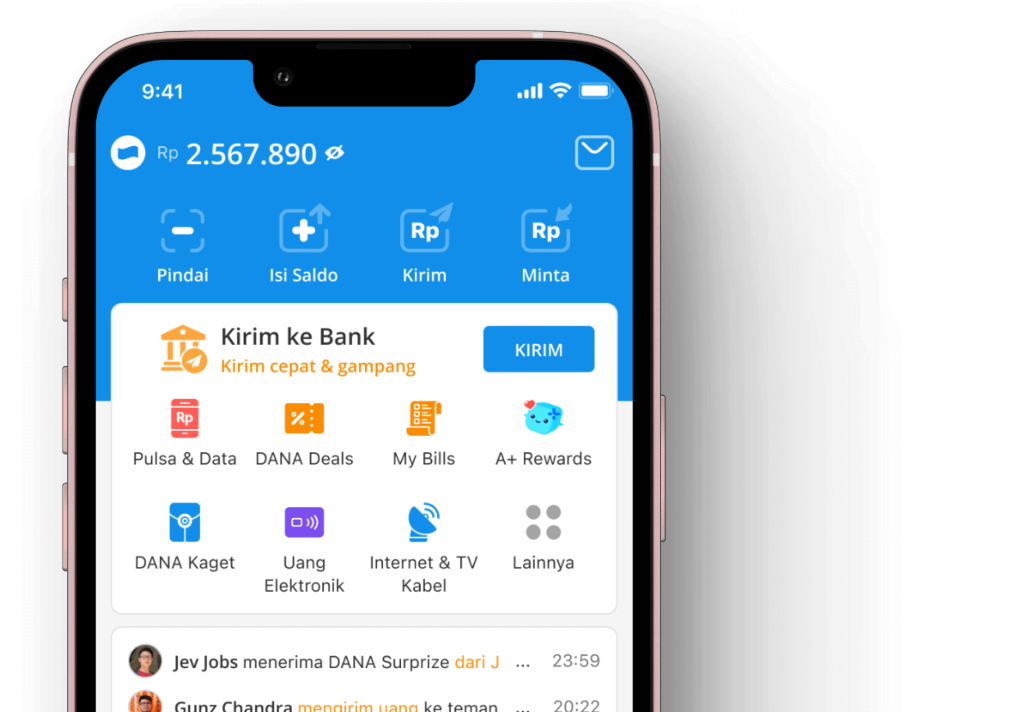

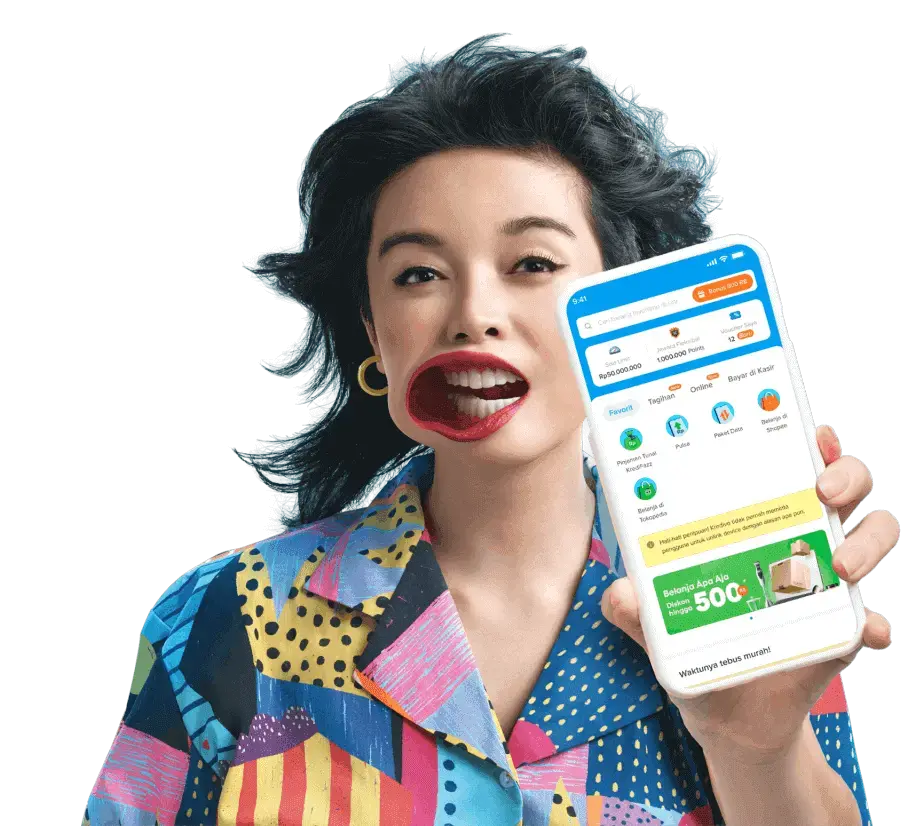

DANA

Source: dana.id.

Founded in 2017, DANA is a digital wallet that has achieved unicorn status, valued at over US$1 billion. Processing more than 10 million transactions daily, DANA supports a variety of financial services—including peer-to-peer payments, e-commerce transactions, insurance, and investment features. Its versatility and scalability make it one of Indonesia’s most influential fintech players.

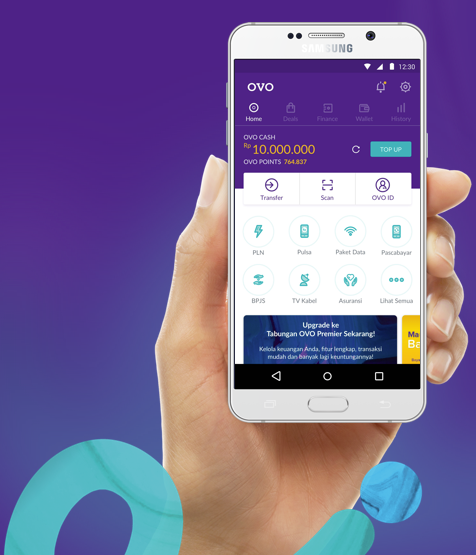

OVO

Source: ovo.id.

OVO started as a digital payments platform launched by Lippo Group, but over time it attracted major investment from Grab. In 2021, Grab acquired a majority stake in OVO, integrating it into its growing financial services ecosystem. Today, OVO offers payments, BNPL services, investments, insurance, and merchant solutions—all seamlessly integrated with Grab’s super-app. With millions of users across Indonesia, OVO is now one of the country’s most prominent fintech players, offering convenience and innovation at scale.

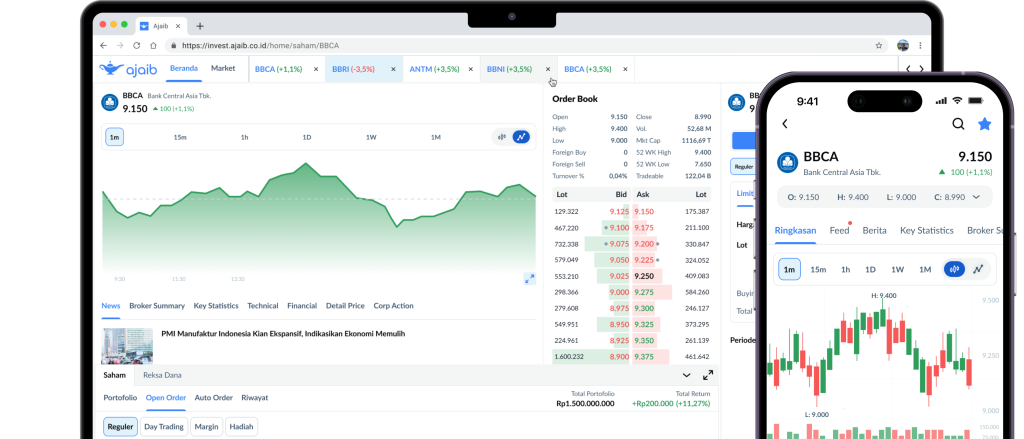

Ajaib

Source: ajaib.co.id.

Ajaib, founded in 2018, is a fintech super-app that democratizes investing in Indonesia. Users can easily invest in stocks, ETFs, and mutual funds through a single platform. Backed by Y Combinator and Ribbit Capital, Ajaib has rapidly scaled to become one of the most downloaded investment apps in the country. Its mission: to empower the next generation of investors to build wealth from their smartphones.

Kredivo

Source: kredivo.id.

Kredivo is a leading digital credit platform that offers flexible “buy now, pay later” (BNPL) solutions for Indonesian consumers. With instant credit approval and transparent fees, Kredivo makes it easy for users to shop online, pay bills, and manage expenses. Its growing user base, strong partnerships with major e-commerce platforms, and commitment to responsible lending have positioned Kredivo as one of Jakarta’s most trusted fintech solutions in 2025.

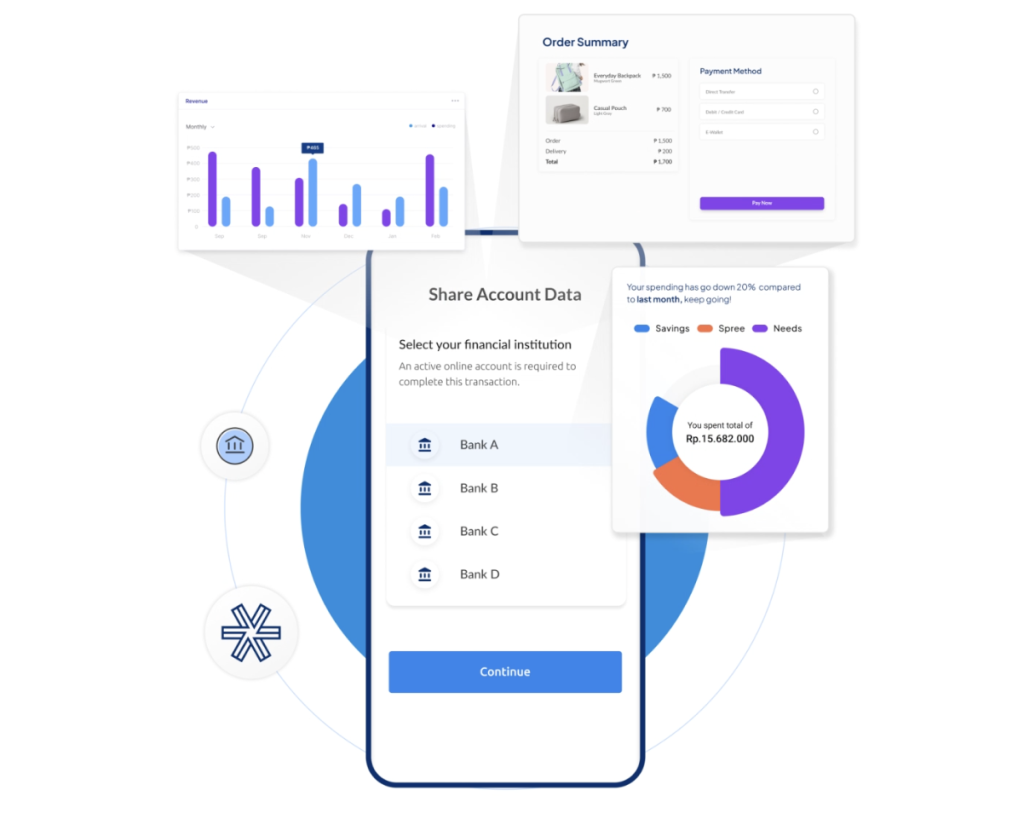

Brankas

Source: brankas.com.

Founded in 2016, Brankas provides banks and large enterprises with the technology needed to launch digital financial products quickly and securely. Its suite of APIs includes embedded payments, transaction services, and banking solutions. By bridging the gap between traditional banks and the digital economy, Brankas is fueling Indonesia’s fintech revolution.

Paper.id

Source: paper.id.

Paper.id focuses on helping SMEs digitize their operations with free invoicing, payment processing, accounting, and inventory management tools. As Indonesia’s small businesses embrace the digital economy, Paper.id is empowering them to work more efficiently, get paid faster, and make smarter financial decisions.

Qelola

Source: qelola.com.

Qelola specializes in cross-border payments, making international remittances faster and more affordable. Its services are particularly useful for freelancers and global businesses in Indonesia, enabling them to send and receive payments with lower fees and greater transparency. With Indonesia’s growing freelance economy, Qelola’s solutions are becoming increasingly vital.

Why these startups matter in 2025

Jakarta continues to lead Southeast Asia’s fintech transformation, with these 13 startups at the forefront of innovation. From digital lending and BNPL to crypto trading and SME enablement, they’re solving real-world problems and expanding financial access across the country. As Indonesia’s digital economy grows, these companies are not just following trends—they’re setting them.

Whether you’re an investor, a startup founder, or simply curious about the future of finance, keeping an eye on these players will give you a front-row seat to what’s next in fintech.